The House of Commons has just released it’s monthly housing figures. They can be seen here, and in summary:

House Prices

-

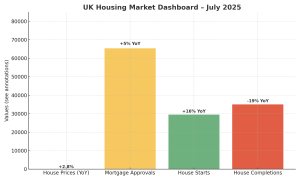

UK house prices rose 2.8% year-on-year (July 2024 → July 2025).

-

Prices fell 0.7% month-on-month (June → July 2025, seasonally adjusted).

-

Strongest annual growth: North East, Northern Ireland, North West.

-

Weakest: London, South East, South West.

Mortgage Approvals

-

65,352 mortgages approved in July 2025.

-

Up 5% on July 2024, and 1% on June 2025.

-

Approvals remain below post-pandemic highs but point to steady buyer demand.

Housebuilding

-

29,490 starts in Q2 2025 → up 2% on Q1, and 16% on Q2 2024.

-

34,990 completions in Q2 2025 → down 2% on Q1, and 19% on Q2 2024.

-

Starts peaked in mid-2023 as builders rushed projects ahead of new energy and EV standards; volumes since have normalised.

What it means for landlords and investors

-

Prices cooling, not collapsing: Annual growth is still positive, but month-to-month declines suggest softer conditions ahead.

-

Regional opportunities: Northern markets show strongest growth; London and the South remain subdued.

-

Mortgage market steadying: More approvals signal buyer activity, supporting sales pipelines and rental demand.

-

Supply squeeze: With completions falling, fewer homes are coming to market—keeping upward pressure on rents despite easing house price growth.

Next Updates

-

UK House Price Index – 22 October 2025

-

Bank of England Money & Credit – 29 September 2025

-

Housebuilding stats – December 2025

0 Comments